The complete breakdown of LTO Fees: Registration, licensing, and penalties in the Philippines

- KEY TAKEAWAYS

- Importance of understanding LTO fees

- Motor Vehicle User’s Charge (MVUC)

- MUVC fees for LTO car registration renewal

- MUVC Fees for old private cars

- MVUC fees for electric vehicles

- LTO penalty fees for late registration

- Other LTO fees for car registration

- LTO fees for driver's license application and renewal

- LTO fees for traffic rules violation

Whether it's for work or leisure, driving is a convenient and popular mode of transportation in the Philippines. But with this convenience comes a responsibility – the responsibility to drive safely and follow the rules of the road. In the Philippines, the Land Transportation Office (LTO) plays a crucial role in ensuring road safety and order. Another important role played by the LTO is to decide all the fees, charges, and penalties related to driving and owning a vehicle in the Philippines. If you are a vehicle owner in the Philippines, you will be transacting with the LTO for one or more reasons. This article will guide you through all kinds of fees associated with owning a vehicle, including registration fees, licensing fees, violation penalties, and more. So let’s get started!

KEY TAKEAWAYS

What are the MVUC fees for electric vehicles?

Electric vehicles pay MVUC similar to motorcycles, with a 30% discount for battery-operated and 15% for hybrid electric vehicles.How much does it cost to renew a driver's license?

Renewal fees range from ₱585 to ₱910, depending on how long the license has been expired.What fees do I need to pay for vehicle registration in the Philippines?

Vehicle registration fees include the MVUC, which varies by vehicle type and weight, inspection fees (₱90-₱115), and license plate fees (₱450 for cars).What are the penalties for late vehicle registration?

Late registration penalties range from ₱100-₱200. Delays over a month incur a 50% surcharge on the MVUC, and driving an unregistered vehicle can lead to higher fines.Importance of understanding LTO fees

Every driver and car owner in the Philippines must learn about the LTO fees. They include costs for various services. These are vehicle registration, getting and renewing a driver's license, and fines for breaking traffic laws. It's key to know these costs of budgeting and following the law. If you know the LTO fees, you can avoid surprise costs and make sure to renew registrations and licenses on time. This avoids any fines or problems with the law. Plus, the LTO uses these fees for important things. They fund safety projects for roads, building infrastructure, and running the office. These things help everyone who uses the road.

Motor Vehicle User’s Charge (MVUC)

When you get your car registered in the Philippines, there's a required fee - the MVUC. It's also called the road user's tax and is required by the LTO for registration. The MVUC is a big part of the tax reform program the Philippines put in place, under Republic Act 8794. Its main job is to bring in money for keeping national and provincial roads in good shape. This money makes sure our roads stay safe and work well for everyone.

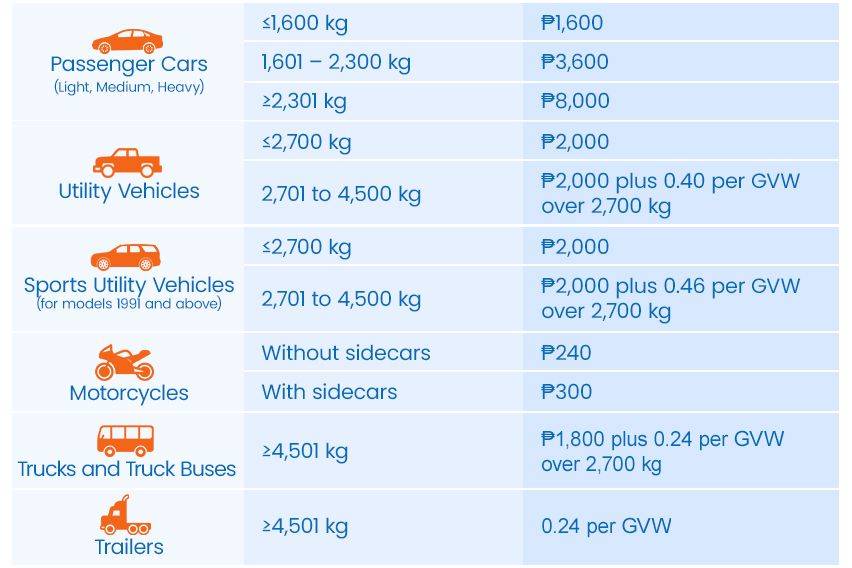

MUVC fees for LTO car registration renewal

When it comes to paying the MVUC in the Philippines, the fee varies depending on the type and weight of the vehicle. For motorcycles without a sidecar, the fee is ₱240, while those with a sidecar pay ₱300. Light passenger cars, weighing up to 1,600 kg, have an MVUC of ₱1,600. Medium passenger cars, with a weight range of 1,601 kg to 2,300 kg, are charged ₱3,600. Heavy passenger cars, which weigh 2,301 kg and above, incur a fee of ₱8,000.

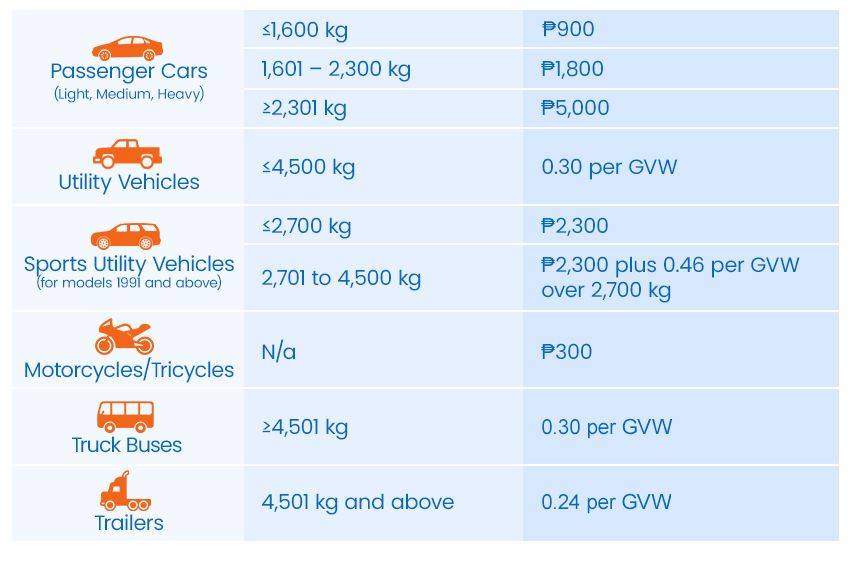

Utility vehicles are categorized differently based on their weight. For those up to 2,700 kg, the fee is ₱2,000. If the utility vehicle weighs between 2,701 kg and 4,500 kg, the fee is ₱2,000 plus an additional 0.40 pesos for every kilogram exceeding 2,700 kg. SUVs from 1991 models and later also have different charges. Those up to 2,700 kg are charged ₱2,300, while those between 2,701 kg and 4,500 kg pay ₱2,300 plus 0.46 pesos per kilogram over 2,700 kg.

For trucks weighing over 4,501 kg, the MVUC is ₱1,800 plus an extra 0.24 pesos for every kilogram beyond 2,700 kg. Trailers in the same weight category (4,501 kg and above) are charged 0.24 pesos per kilogram of their gross vehicle weight.

MUVC Fees for old private cars

The MVUC fees you pay in the Philippines also depend on the model year of the car and are categorized based on different weight groups. Here’s the detailed breakdown:

Light cars (up to 1,600 kg):

- 1995-2000 models: ₱2,000

- 1994 and older: ₱1,400

Medium cars (1,601 kg to 2,300 kg):

- 1997-2000 models: ₱6,000

- 1995-1996 models: ₱4,800

- 1994 and older: ₱2,400

Heavy cars (2,301 kg and above):

- 1995-2000 models: ₱12,000

- 1994 and older: ₱5,600

MVUC fees for electric vehicles

In the Philippines, the MVUC for electric vehicles is similar to motorcycles. For two-wheeled light electric vehicles (LEVs), the MVUC is the same as for motorcycles without a sidecar. For three-wheeled LEVs, the MVUC is equivalent to the fee for motorcycles with a sidecar. Additionally, battery-operated vehicles benefit from a 30% discount on the MVUC, while hybrid electric vehicles receive a 15% discount.

LTO penalty fees for late registration

There are various penalty structures in place for late vehicle registration in the Philippines. If you miss the designated registration week for your plate number, a minimal fee of ₱200 (cars) or ₱100 (motorcycles) applies. Delays exceeding a month but within a year incur a 50% surcharge on the Motor Vehicle User's Charge (MVUC). For delinquencies beyond a year, the penalty is 50% of the MVUC, with an additional renewal fee for each missed year. Apprehensions for driving an unregistered vehicle during this period further increase the penalty to 50% of the MVUC plus renewal fees for all unregistered years. Timely registration is recommended to avoid these additional charges.

Other LTO fees for car registration

Getting your car inspected by the LTO will cost ₱90 if it weighs less than 4,500 kg and ₱115 if it weighs more. Regular license plates cost ₱450 and motorcycle plates are ₱120. There's a ₱50 fee for stickers and replacing a lost or damaged plate will cost ₱450. Vanity plates can set you back up to ₱35,000! If you want to modify your car's body design, transfer the ownership of the vehicle to someone else, or change the venue of your registration, that will each cost ₱100. Revising the vehicle's gross weight will cost ₱30 and transferring ownership costs ₱50 per transfer.

LTO fees for driver's license application and renewal

The fees for various driver's license transactions are as follows: Obtaining a student permit costs ₱250, while a new driver's license costs ₱685. For renewing a driver's license, the cost depends on its expiration status. If it's still valid or unexpired, the fee is ₱585. If it has expired for 1 day to 1 year, the renewal fee is ₱660. If it has expired for over 1 to 2 years, the fee is ₱735, and for over 2 years, it’s ₱910.

For a duplicate valid license, the fee is ₱355, but if revision of records is needed, it costs ₱455. A duplicate student permit is ₱280.

For changing the license code classification, valid non-pro to pro costs ₱425, valid pro to non-pro is ₱325, and if the license is expired, changing from non-pro to pro (or vice versa) is ₱785 plus a penalty.

LTO fees for traffic rules violation

Be aware of road safety and traffic rules in the Philippines to avoid fines! Here's a breakdown of some common offenses and their penalties:

- No License: ₱3,000

- Driving under the influence: ₱50,000 - ₱500,000 (plus possible license confiscation)

- Crime-related vehicle use: ₱10,000 (plus license confiscation)

- No seatbelt: ₱1,000 (1st), ₱2,000 (2nd), ₱5,000 (3rd+) (includes children under 6 in the front seat)

- No helmet: ₱1,500 (1st offense) to ₱10,000 (4th and succeeding)

- Missing registration/receipt: ₱1,000

- Reckless driving: ₱2,000 (1st), ₱3,000 (2nd), ₱10,000 (3rd+)

- Fake driver's license documents: ₱20,000

- Traffic violations such as parking violation, disregarding traffic signs, illegal turn, illegal overtaking, and others listed under the Joint Administrative Order No. 2014-01: ₱1,000

- Unregistered vehicle: ₱10,000

- Improper license plate: ₱5,000

- Smoke belching: ₱2,000 (1st offense) to ₱6,000 (3rd offense)

- Unauthorized modifications: ₱5,000

- Missing/faulty vehicle equipment: ₱5,000

- Registration/renewal fraud: ₱3,000

- Other registration/operation violations: ₱2,000

Final thoughts

If you’re driving in the Philippines, it's important to understand LTO rules and charges. Being aware of these regulations, from MVUC fees to driver's license renewals, helps drivers avoid penalties and stay law-abiding. These charges play a part in traffic safety and the growth of infrastructure. And, if you’ve decided to go green, there’s some good news for you! Electric vehicle owners can grab discounts. Always remember, a delay in registration or breaking traffic rules equals fines. Timeliness and safe driving are key. Gaining knowledge about these points helps save money, advance public work, and make our roads safer. By appreciating and following these rules, not only are we protecting ourselves but we're also fostering a safe driving culture in the Philippines.

Also Read: Learn how to clear your unsettled traffic violations online

Featured Articles

- Latest

- Popular

Recommended Articles For You

Featured Cars

- Latest

- Upcoming

- Popular

Car Articles From Zigwheels

- News

- Article Feature

- Advisory Stories

- Road Test