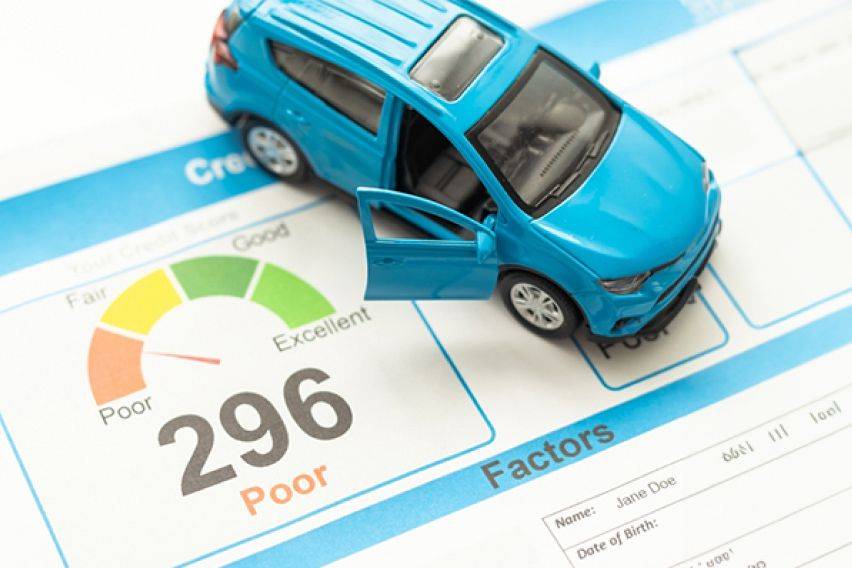

Car financing solutions for buyers with bad credit in the Philippines

In the Philippines, financing is the go-to method for purchasing a car, and a good credit score often speeds up the loan approval process. But what happens when your credit score isn't stellar? Can you still secure financing for your vehicle? The answer is yes. This comprehensive guide explores the financing options available for individuals with bad credit, offering practical solutions to help you drive away in your dream car.

KEY TAKEAWAYS

What are the risks associated with bad credit loans?

Bad credit loans often come with higher interest rates and shorter loan terms, leading to higher monthly installments. Failing to repay on time can further damage your credit history. It may lead to aggressive debt recovery practices, especially with certain fintech companies.What are the interest rates for bad credit loans from private lenders?

Interest rates for bad credit loans from private lenders are typically higher than traditional loans, ranging from 4% to 8% per month. Given the higher monthly instalments, it is important to assess your ability to repay these loans.What are bad credit loans, and who can apply for them?

Bad credit loans are designed for individuals with poor or no credit history. They offer a way to secure financing despite having a low credit score. These loans are accessible to those rejected by traditional lenders like banks and government agencies.Can I get a car loan with a bad credit score in the Philippines?

Yes, you can still get a car loan in the Philippines with a bad credit score. Several financing options are available, such as private lenders, car collateral loans, fintech companies, pawn shops, and car dealerships offering in-house financing.Having a bad credit score does limit your car loan options since well-known banks and government agencies often hesitate to lend to such borrowers. However, some financial institutions specialize in approving loans for applicants with poor credit scores. While improving your credit score is a lengthy process, it doesn't have to prevent you from getting a car loan. As long as you've carefully assessed your financial situation and are confident in your ability to make timely monthly payments, you can still secure the financing you need.

Bad credit loans are loans offered to borrowers with poor credit scores. They are a way to access finance options not just for people with poor credit histories but also for those without credit histories at all.

Financing options for car buyers with a bad credit score

Banks and credit unions

While most reputed banks and credit unions may reject your loan application, some still consider applicants with a bad credit history. The process may be longer, and you may be required to present additional documents, but there are good chances to secure a loan.

Private lenders

Many private lending companies offer quick personal loans with minimum documentation and consider borrowers with low credit scores. The only catch is that they charge a higher interest rate. Monthly interest rates may range between 4% to 8% per month, almost 4-8 times higher than traditional lending institutions. So, before considering these loans, assess your paying capacity and the urgency of the need. Bad credit loans from private lenders are quick and require minimum documentation (valid government IDs are sufficient). The application process can be done online, and the amount is disbursed on the same day in most cases.

Car collateral loan

If you already have a car and are looking to get a loan for another car, you can quickly get against the OR/CR of the car you own. Remember, this is not an unsecured loan, and the lending agency uses the car as collateral. However, they do not physically keep your car as a guarantee, and you can continue to use it. If you default on your loan, they will recover the cost by ceasing and auctioning the car.

Fintech companies

There's been a massive rise in fintech companies in the Philippines over the last few years. These companies also offer unsecured loans to borrowers with bad credit scores. You can apply for a loan through these companies and avail quick cash. But be careful; these companies follow a strict recovery procedure if you default on your loans. There have been cases where they repeatedly harass the borrower and even contact the references they provide during the application. However, you can report such cases as it is an unauthorized way to recover debt, and there are set rules for such instances that levy a fine and carry legal proceedings against such companies. So, be aware of your rights as a borrower.

Pawn shops

Many pawn shops in the Philippines offer instant cash against collateral like jewellery, property, OR/CR of already owned car, or any other valuable asset to get cash. The amount of money depends on the terms and conditions of shop owners, and it is a secured loan. The interest rates are usually very high.

Financing through car dealerships: Many car dealerships offer in-house financing, which might be more flexible with credit requirements than traditional banks. These dealerships finance the car purchase directly at higher interest rates.

Second-chance auto loans

A second-chance auto loan, or subprime car loan, is offered to borrowers with bad credit who can't get approved for traditional auto loans. The eligibility guidelines for second-chance auto loans vary significantly among lenders. Some lenders require a minimum credit score and may have an income requirement. Others may not have a minimum credit score requirement but have an income requirement and limited loan options. You will almost certainly have to pay a higher interest rate with a second-chance auto loan.

5-6 lending scheme

The 5-6 lending scheme, also known as informal lending, is prevalent in the Philippines, particularly among micro and small business owners. Despite its notorious reputation for charging exorbitant interest rates, typically around 20%, it remains a deeply entrenched practice in Filipino culture.

A couple of things are pretty straightforward. You can avail yourself of a car loan in the Philippines even with a bad credit score, but you will have to pay a higher interest rate. Borrowing from lenders that provide bad credit loans is expensive and risky. The monthly installment is generally high as the loan term is low, ranging between 18-24 months. Furthermore, if you are caught in a debt trap and somehow not able to repay on time, your credit history will be further impacted, making the situation worse. So proceed with caution when it comes to bad credit loans.

What are the advantages of bad credit loans?

While there are many downsides to opting for a bad credit loan to finance your car, there are certain advantages as well.

Fast processing time: Many of these loans are available online, allowing lenders to respond quickly. With minimal requirements, lenders can often deposit the funds into your bank account within 30 minutes, depending on the loan amount and lender process.

Higher approval rates

Lenders offering bad credit loans generally have lenient requirements. By providing personal information, valid IDs, and possibly collateral, your application stands a good chance of approval. The specific approval criteria may vary depending on the lender.

Elevated borrowing limits

Collateral or secured loans, such as OR/CR loans, often offer high borrowing limits. For example, you can borrow up to 70% of your car's value. Significant loan amounts can also be obtained by pawning rare jewellery and high-end items.

No credit history needed in most cases

Bad credit loans are accessible even to those with no credit history. First-time borrowers and individuals with no existing debt can benefit from these loans, which can be particularly useful in emergencies for financially responsible individuals without credit records.

Flexible use of funds

These loans are versatile and suitable for various needs such as emergencies, debt consolidation, or car purchases. However, it is advisable to avoid using the funds for activities that can generate more debt.

Conclusion

Owning a car in the Philippines, despite having bad credit, is still possible. With careful planning and responsible borrowing, your dream car can still be within reach. However, the most important factors to consider are the high interest rates charged by these lenders and the shorter loan duration with stricter terms and conditions. Before pursuing a bad credit loan, carefully assess your financial situation and borrowing capacity. Defaulting on repayments could further damage your credit score, a consequence far from desirable.

Also Read: Congratulations, you've fully paid for your used car. Now, what's next?

Featured Articles

- Latest

- Popular

Recommended Articles For You

Featured Cars

- Latest

- Upcoming

- Popular

Car Articles From Zigwheels

- News

- Article Feature

- Advisory Stories

- Road Test