Car loan scams in the Philippines: Applicants be aware

- KEY TAKEAWAYS

- Car loan scams in the Philippines

- 1. Fake Loan Offers

- 2. Identity theft

- 3. Loan shark scams

- 4. Fake online lending companies

- 5. ‘Pasalo’ scams

- Ways to spot car loan scam

- 1. Guaranteed approval

- 2. Pressure to act quickly

- 3. No contact information

- 4. Request for upfront fees

- 5. Unsolicited loan offers

- Tips to stay protected from car loan scams

- 1. Verify lender’s credentials

- 2. Avoid paying upfront fees

- 3. Do thorough research

- 4. Secure personal information

- 5. Ask questions

- 6. Be financially literate

- Ways to avoid online car loan scams

- 1. Use secure websites

- 3. Check online reviews and complaints

- 4. Avoid online loan offers

- What to do if you get scammed?

- 1. Cancel the transaction

- 2. Contact your bank

- 3. Document everything

- 4. Report to authorities

- 5. Seek legal assistance

In the Philippines, car loans have become a popular method of financing vehicle ownership. Why? Well, that’s due to the ease of payment the customers get to enjoy over time. However, along with the rise of car loan applications, fraudulent activities targeting car loan applicants have surged over the past few years.

KEY TAKEAWAYS

Is it safe to apply for a car loan online?

While online applications can be safe, always ensure you are dealing with a reputable lender. However, make sure to use secure websites, avoid public Wi-Fi, and check reviews.What is the most common car loan scam in the Philippines?

One of the most common scams is the advance fee scam, where applicants are asked to pay upfront fees for loan processing.How can I check if a lender is legitimate?

Always verify the lender’s registration with the SEC or the BSP. Visit their websites or contact them directly to check if a lender is authorized to operate.It is therefore crucial for all applicants applying for a car loan in the Philippines to understand the tactics scammers use and know how to avoid such traps.

Also Read: Here's why your car loan can get rejected in the Philippines

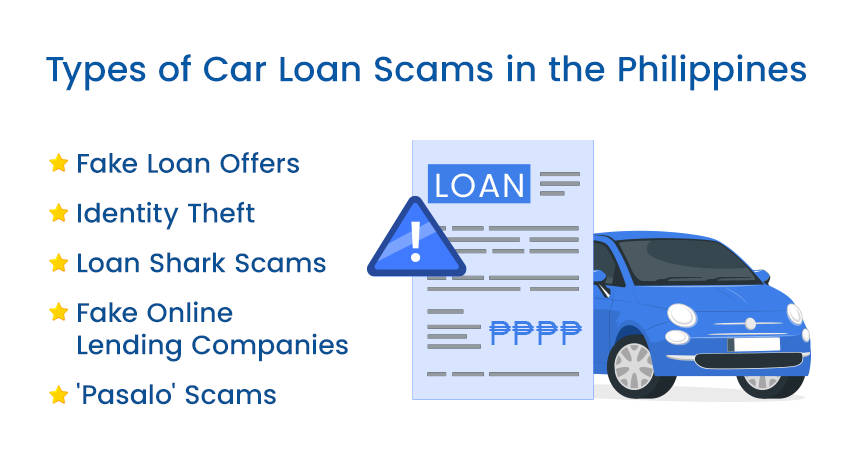

Car loan scams in the Philippines

There are five major types of car loan scams taking place in the country including,

- Fake loan offers

- Identity theft

- Loan shark scams

- Fake online lending companies

- ‘Pasalo’ scams

Let us now talk about each of these scams in detail -

1. Fake Loan Offers

Some scammers pose as legitimate loan providers, offering quick car loans with easy approval processes. They often ask for upfront payments, supposedly to cover processing fees or down payments. However, once the payment is made, the scammers disappear. Always be aware of lenders who ask for payment before loan approval.

2. Identity theft

Fraudsters often trick car loan applicants into providing personal information, such as their bank account details or social security numbers, under the guise of processing loan applications. Once they have this information, they can steal the applicant’s identity and use it for financial fraud.

3. Loan shark scams

Loan sharks offer loans with extremely high interest rates and harsh repayment terms. These lenders usually bypass traditional checks and claim to offer fast loans. However, failure to meet the repayment terms at the applicant's end can lead to harassment and threats, often involving the illegal repossession of the vehicle.

4. Fake online lending companies

Some online scammers create fake lending websites, mimicking real companies. Such scammers collect application fees and all sensitive information from the applicants but offer no real loan in return. Therefore, it is vital for all to first check the legitimacy of the lender by verifying their registration number given by the Securities and Exchange Commission (SEC).

5. ‘Pasalo’ scams

In the Philippines, the ‘Pasalo’ system enables a car owner to transfer the loan obligation to another person. Scammers take advantage of this system by posing as sellers of cars under ‘Pasalo’ agreements. They collect a down payment, promising to transfer the car and loan but disappear once the money is received.

Also Read: Here's why your car loan can get rejected in the Philippines

Ways to spot car loan scam

1. Guaranteed approval

Legitimate lenders never guarantee loan approval before reviewing your application and financial background. If someone guarantees approval without checking your creditworthiness, it’s a major red flag.

2. Pressure to act quickly

Scammers often pressure applicants to act fast, citing limited-time offers or steep discounts. This tactic is designed to rush applicants into making decisions without verifying the authenticity of the lender.

3. No contact information

If the lender does not provide clear contact details, such as an office address, phone number, or website, it’s a warning sign. Scammers often operate from anonymous or fake online accounts.

4. Request for upfront fees

A common tactic among scammers is to ask for upfront payments to secure the loan. Reputable lenders typically deduct fees from the loan amount or integrate them into monthly payments and not demand them upfront.

5. Unsolicited loan offers

Be cautious of unsolicited loan offers, especially those that come via text messages, emails, or social media platforms. Scammers use these channels to attract victims with promises of low interest rates and easy approval.

Tips to stay protected from car loan scams

There are several ways a loan application can protect oneself from ongoing car loan scams in the country. Let us learn about them in detail -

1. Verify lender’s credentials

First and foremost verify if the lender is registered with the Securities and Exchange Commission (SEC) or the Bangko Sentral ng Pilipinas (BSP). Also, check for any advisories or complaints against the lender. If the lender is not on the official list, steer clear.

2. Avoid paying upfront fees

Always remember that a legitimate lender will not ask for upfront fees for processing a loan. Fees, if any, are deducted from the loan amount or paid after the loan is disbursed. If a lender insists on upfront payments, it’s likely a scam.

3. Do thorough research

Before applying for a loan, take note to research the lender thoroughly. Check out reviews, customer testimonials, and any complaints filed against them.

4. Secure personal information

Take note that you never share sensitive personal information, such as your bank details, through insecure platforms or websites. Make sure the website has a secure connection. Avoid sharing personal details over the phone unless you’re certain of the caller’s legitimacy.

5. Ask questions

Legitimate lenders will be happy to answer any questions you have about the loan terms, fees, and repayment schedule. Scammers often avoid detailed questions and provide vague answers. Asking specific questions can help you gauge the legitimacy of the lender.

6. Be financially literate

Financial literacy is the key to preventing loan scams. Many victims these days fall prey to fraud because they lack a clear understanding of how loans work and legitimate loan processes. We recommend applicants familiarize themselves with standard loan terms, such as interest rates, repayment schedules, and processing fees. These days several banks and government agencies are offering free financial literacy seminars, which can teach individuals how to avoid loan scams.

Ways to avoid online car loan scams

The rise of digital lending platforms has created both opportunities and risks. Many scammers exploit online channels to target car loan applicants. Here are specific precautions when applying for loans online:

1. Use secure websites

Scammers often create websites that look almost identical to legitimate ones. Be sure to check the URL of any lending website for an “https” prefix, indicating that the site is secure. Furthermore, avoid inputting personal information on websites with suspicious domain names or designs that seem unprofessional.

2. Avoid using public Wi-Fi

When applying for loans or sharing personal financial information, it’s important to avoid using public Wi-Fi networks. These networks are often unsecured, making it easier for hackers to intercept your data.

3. Check online reviews and complaints

Social media platforms and consumer forums are valuable resources for checking the legitimacy of online lenders. Fraud victims often report their experiences online, warning others of scams. Before transacting with a lender, search for reviews and testimonials from previous clients to ensure they are trustworthy.

4. Avoid online loan offers

Scammers frequently advertise fake car loans on social media, enticing victims with promises of low interest rates and fast approval. These fraudulent ads often redirect users to fake websites or ask for personal information upfront. Be extremely cautious of unsolicited offers from lenders on platforms like Facebook or Instagram

What to do if you get scammed?

If you’ve fallen victim to a car loan scam or suspect fraudulent activity, it’s important to act quickly to minimize losses. Here’s what you can do:

1. Cancel the transaction

If the scammer gained access to your bank account or credit card details, contact your bank immediately to cancel the transaction. Many banks can reverse fraudulent transactions if they are reported promptly.

2. Contact your bank

If you’ve already made a payment, immediately contact the bank to stop the transaction. Request the authorities to freeze or reverse the payment if possible. Monitor your account for any unauthorized transactions.

3. Document everything

Keep records of all communications, receipts, and any evidence of your dealings with the scammer. All this information will help while reporting the case to authorities or while seeking legal help.

4. Report to authorities

Next, report the scam to the Philippine National Police Anti-Cybercrime Group (PNP-ACG) or the National Bureau of Investigation (NBI). Both these agencies have divisions that handle online fraud and scams.

If the scam involves a registered or fake lending company, you can file a complaint with the Securities and Exchange Commission (SEC). The SEC has the authority to investigate and take legal action against fraudulent companies

5. Seek legal assistance

If the scam involves a significant amount of money, we’d advise you to consult a lawyer to help recover the funds or file charges against the scammer.

Bottom line

These days car loan scams are becoming increasingly sophisticated in the country, targeting unsuspecting individuals through fake loan offers, identity theft, and fraudulent car dealership schemes. We’d advise all applicants to always verify the legitimacy of lenders and remain cautious of unsolicited offers, guaranteed approvals, and upfront payment demands.

Also Read: Car insurance scams in the Philippines: What you need to know

Featured Articles

- Latest

- Popular

Recommended Articles For You

Featured Cars

- Latest

- Upcoming

- Popular

Car Articles From Zigwheels

- News

- Article Feature

- Advisory Stories

- Road Test