Car loans made simple for OFWs: Everything you need to know

- KEY TAKEAWAYS

- OFWs car loan: Why it is a good idea

- OFWs car loan: Eligibility criteria

- OFWs car loan: Key documents required

- OFWs car loan: Where to apply

- OFWs car loan: Loan terms & payment options

- OFWs car loan: Common pitfalls and tips to avoid them

- OFWs car loan: Useful tips

- OFWs car loan: Hidden cost to look out for

For many Overseas Filipino Workers (OFWs), providing a better life for their families in the Philippines is often a top priority. One way OFWs can enhance their family's comfort is by purchasing a car, but paying upfront in cash can be a challenge, especially with other financial responsibilities. Fortunately, car loans make it easier for OFWs to achieve this goal without stretching their budget too thin.

KEY TAKEAWAYS

How do OFWs make payments while abroad?

OFWs can pay through onlinae banking, remittance services, or by issuing post-dated checks.How long does it take to get a loan approved?

Approval times vary but typically range from 1 to 4 days, depending on how quickly your documents are verified.Why do OFWs need a co-maker?

A co-maker is required because OFWs are not physically present in the Philippines. The co-maker acts as a guarantor.Can OFWs apply for a car loan while working abroad?

Yes, OFWs can apply remotely through online platforms offered by banks and dealerships. They just need to submit all required documents electronically.While OFWs face the unique challenge of being miles away from home, there are numerous car loan options specifically designed for them, enabling them to purchase a vehicle for their family from anywhere in the world. Several Philippine banks and car dealerships offer tailored services that cater to OFWs, making it simple to apply, manage payments, and even have a trusted relative co-sign the loan. This guide breaks down everything OFWs need to know about car loans—from eligibility and requirements to application steps and practical tips—so they can confidently navigate the process while abroad.

Also Read: Car financing solutions for buyers with bad credit in the Philippines

OFWs car loan: Why it is a good idea

For OFWs, acquiring a car for their family back home is a practical and emotional investment. Car loans make it all easier by allowing payments to be spread over several years, preventing a huge upfront financial burden. Thus helping OFWs achieve the goal of providing mobility for their loved ones, for daily commutes, emergencies, or weekend trips.

Moreover, Philippine banks and dealerships offer car loan packages specifically designed for OFWs, easing the process and offering flexible terms even while applicants are abroad.

OFWs car loan: Eligibility criteria

Several basic requirements determine if an OFW is eligible for a car loan, they are as follows -

- Age: Borrowers must be between 21 and 65 years old at the loan's maturity.

- Income: A minimum monthly income of PHP 30,000 to PHP 40,000 is typically required.

- Employment History: A minimum of two years of continuous overseas employment is necessary to ensure stable income.

Note, that some lenders may also consider factors like existing loans or credit card debt, which can impact your eligibility.

OFWs car loan: Key documents required

To apply for a car loan, OFWs must provide a variety of documents to verify their identity and financial capacity. Here's a list of the most common documents -

- Loan application form: Complete and sign the loan application form, ensuring all details are accurate.

- Government-issued IDs: Two valid IDs (e.g., passport, driver's license) of both the borrower and co-maker (if applicable).

- Proof of income: At least three months' worth of payslips or remittance receipts, and an authenticated employment contract.

- Proof of billing: A recent utility bill in the borrower’s or co-maker’s name.

- Co-maker documents: Since OFWs are not physically present to handle all aspects of the loan, a local co-maker is required. This is usually a family member or spouse.

Note, that if an applicant is unable to meet some income or credit requirements, a co-maker’s income may be considered to strengthen your application.

Also Read: Personal loan or car loan: Finding the right financing option for your car

OFWs car loan: Where to apply

Several institutions and dealerships in the Philippines cater to OFWs looking to buy a car -

- Banks: Major Philippine banks like BDO, BPI, and EastWest offer tailored car loans for OFWs, with online applications available for those abroad.

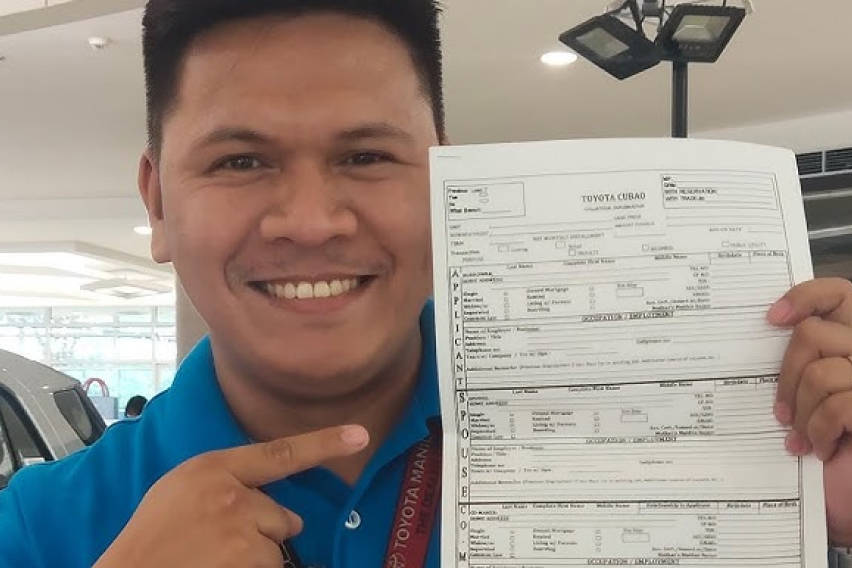

- Car dealerships: Toyota, for instance, offers the Toyota Financial Services program, which simplifies the process for OFWs, allowing remote applications and consultations

- Online platforms: Several websites make it easier for OFWs to compare vehicle options, submit loan applications, and even arrange for car delivery to their families.

OFWs car loan: Loan terms & payment options

Most car loans offer terms ranging from 36 to 60 months. The exact amount of the monthly payments will depend on the loan’s duration and the car's price. For example, a PHP 1,000,000 car with a 20% down payment and a 5-year term might have a monthly payment of around PHP 16,971, excluding insurance and taxes.

There are several channels through which OFWs can pay their loans including,

- Online banking: The easiest and most secure option for remote payments.

- Post-dated checks (PDCs): Some lenders in the Philippines require PDCs to secure monthly payments.

- Remittance: Remittance service is another payment option wherein the co-maker handles the final transactions.

OFWs car loan: Common pitfalls and tips to avoid them

Below are listed some common OFW car loan pitfalls and how they can be avoided.

- Overestimating the budget: OFWs must be mindful of hidden costs like insurance, taxes, and regular maintenance. Ensure that the total cost of owning the car fits comfortably within your budget.

- Uncompleted documents: Missing documents can delay or result in the rejection of your application. Make sure to provide all necessary paperwork.

- Neglecting loan terms: While longer loan terms may lower monthly payments, they increase the total interest paid. Weigh these factors carefully before deciding on a loan term.

Also Read: Beginner's guide to financing a used car in the Philippines

OFWs car loan: Useful tips

- Plan ahead: Start gathering documents, especially those requiring consular authentication, before returning to the Philippines. This can help expedite the application process.

- Choose the right vehicle: Consider your family’s needs when selecting a car. For instance, if the car will be used for family trips, an SUV or MPV may be more suitable than a sedan.

- Use online tools: Car loan calculators available on dealership websites can help you estimate your monthly payments and budget more effectively.

- Maintain good credit: A positive credit record will significantly improve your chances of approval.

- Choose a reliable co-maker: Make sure your co-maker has a stable income and a good credit standing.

- Provide complete documentation: Ensure that all your paperwork is in order and up-to-date.

- Submit additional collateral: If available, submitting proof of ownership of other assets (e.g., real estate) can improve your credibility as a borrower.

OFWs car loan: Hidden cost to look out for

Apart from the loan's principal and interest, borrowers should also consider the following additional costs -

- Insurance: Comprehensive car insurance is often required by lenders, and the cost can significantly increase your overall car ownership expenses.

- Chattel Mortgage Fee: This is the fee for registering the vehicle as collateral with the Land Transportation Office (LTO). It’s a one-time payment but can add a notable amount to your initial costs

- Taxes: Local government units may also impose vehicle-related taxes and fees that vary by location.

Bottom line

For OFWs, buying a car for their family back home is a rewarding investment that is now more accessible than ever. With tailored car loan options, online tools, and dealership programs designed specifically for overseas workers, the process has never been simpler. By understanding the loan terms, preparing the required documents, and choosing the right payment methods, OFWs can confidently secure a car loan and provide their families with the convenience and mobility they deserve.

Also Read: Here's why your car loan can get rejected in the Philippines

Featured Articles

- Latest

- Popular

Recommended Articles For You

Featured Cars

- Latest

- Upcoming

- Popular

Car Articles From Zigwheels

- News

- Article Feature

- Advisory Stories

- Road Test