A step-by-step guide on how to claim car insurance in the Philippines

Car insurance is an essential aspect of vehicle ownership, providing financial protection against unforeseen circumstances such as accidents, theft, and natural disasters. However, merely having a car insurance policy is not enough; understanding how to utilize it effectively when the need arises is equally important. This step-by-step guide aims to provide you with clarity on how to claim car insurance in the Philippines effectively. So, without further ado, let’s get started.

Save Up to 60% on Car Insurance Renewal

- CASA Coverage Up To 10 Years Old

- Free Roadside Assistance

- Free Acts of God/Acts of Nature

T&C

T&C

Understanding your car insurance policy

Before diving into the claims process, it's important to understand the specifics of your car insurance policy. In the Philippines, there are mainly two types of car insurance policies - CTPL insurance (Compulsory Third-Party Liability Insurance) and Comprehensive Insurance.

CTPL protects you against legal liabilities for bodily injury caused to a third party in an accident where you are at fault, while comprehensive insurance covers damage to your vehicle as well as third-party, protecting you from a wide range of risks associated with owning and driving a car.

Take the time to review your insurance policy thoroughly. Understand the coverage limits, deductibles, and any exclusions that may apply. This knowledge will help you determine what expenses your insurance provider will cover and what you may need to pay out of pocket.

Preparing for the claim

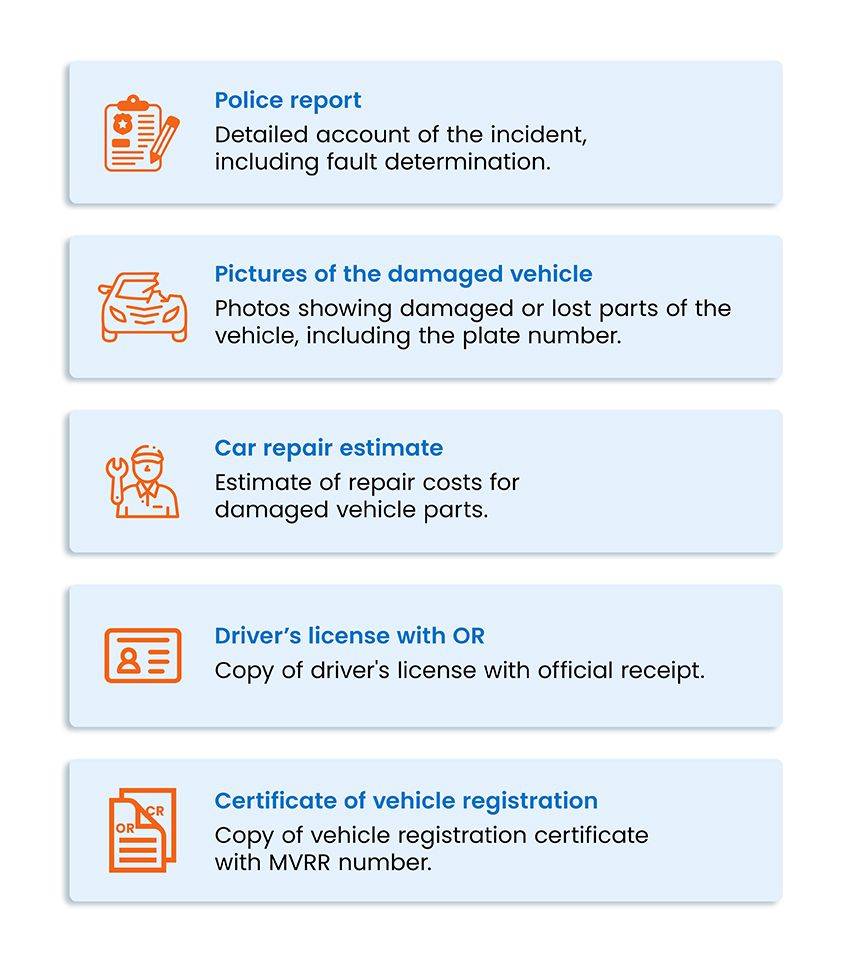

Preparation is key when filing a claim. Start by gathering all necessary documents, including your insurance policy details, vehicle registration documents, and any relevant photographs or documentation related to the incident.

If the incident involves an accident, obtaining a police report is essential. This official document provides crucial details about the circumstances of the incident and is often required by insurance companies when processing claims. In the case where fault determination is necessary, a police report is also necessary.

Contact your insurance provider promptly to inform them of the incident and inquire about the specific procedures and documentation required to file a claim. Generally, you will be required to provide the following primary and supporting documents at the time of filing your claim.

Primary requirements

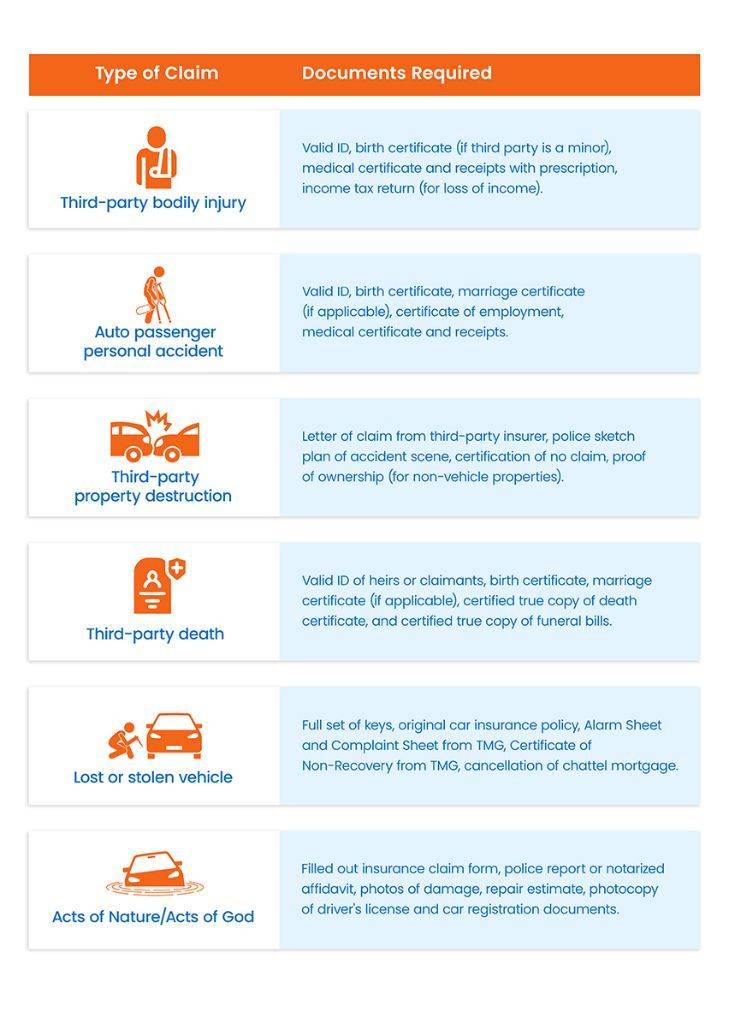

Additional requirements, depending on the type of claim.

Filing the claim

Once you have gathered all the necessary information, documents, and evidence of the incident, you can proceed with filing a claim. Here are various ways to claim car insurance in the Philippines:

Tips for a smooth filing of a car insurance claim

Here are some tips for a smooth filing of an insurance claim:

- Notify your insurance provider as soon as an incident occurs. Prompt reporting can help expedite the claims process and prevent delays

- Don't agree to settlements directly with the third party involved in the incident without informing your insurer

- Maintain detailed records of the incident, including photographs, witness statements, and any relevant documentation to support your claim

- Familiarize yourself with the terms and coverage limits of your insurance policy

- Pay attention to all the general and specific instructions provided by your insurance company regarding the claims process

- Ensure that all information provided on claim forms is accurate and complete to avoid delays or complications in processing your claim

- Maintain open and clear communication with your insurance provider throughout the claims process for faster resolution

- If you haven't received updates on your claim within a reasonable timeframe, don't hesitate to contact your insurance provider

- If you encounter difficulties or have questions during the claims process, don't hesitate to seek assistance from your insurance agent or broker

- While you may be eager to resolve your claim quickly, remember that the process can take time, especially for complex cases

FAQs related to car insurance claim

How long does it take to process a car insurance claim?

The processing time for a car insurance claim depends on factors like its complexity, the responsiveness of involved parties, and other factors. Simple claims typically take weeks, while complex ones may require more time.

Will filing a car insurance claim affect my premiums?

Filing a car insurance claim may impact your premiums, as insurance companies consider your claims history when determining your rates.

Is there a time limit for filing a car insurance claim in the Philippines?

While different insurance policies have different time limits for filing a claim, it's advisable to report any incidents and file your claim as soon as possible.

How can I check the status of my car insurance claim?

You can check the status of your car insurance claim by contacting your insurance provider's claims department and providing your claim reference number.

What could lead to the rejection of my car insurance claim?

Your car insurance claim could be denied for several reasons, such as unpaid premiums, intentional damage or misconduct, accepting settlements without informing your insurer, or unlawful activities while driving.

Summing up

So, there you have it—your go-to guide to claiming car insurance in the Philippines. With these steps, you are ready to tackle any bumps in the road ahead. Stay safe out there, and know that your car insurance is there for you when you need it most!

Also read: Car Insurance for pre-owned vehicles: A comprehensive guide

Featured Articles

- Latest

- Popular

Recommended Articles For You

Featured Cars

- Latest

- Upcoming

- Popular

Car Articles From Zigwheels

- News

- Article Feature

- Advisory Stories

- Road Test