All you need to know about ‘Loss of Use’ car insurance coverage

- KEY TAKEAWAYS

- Key benefits of Loss of Use coverage

- Ensures continued mobility

- Reduces financial burden

- Flexibility in transportation choices

- How Loss of Use coverage works

- Key points about how Loss of Use coverage works -

- Loss of Use coverage: Major queries answered

- #1 Is Loss of Use coverage included in all car insurance policies?

- #2 Can an applicant claim Loss of Use coverage without renting a car?

- #3 Under what circumstances might Loss of Use coverage not be useful for an applicant?

- The process to file a Loss of Use claim

- Loss of Use coverage: Needed or not

When owning a car in the Philippines, unexpected accidents or mishaps can disrupt the user’s mobility, especially when the car has gone for repair or restoration. In the picture enters ‘Loss of Use’ insurance coverage which protects the car owner in such cases. Loss of use coverage is an optional but invaluable add-on that reimburses the user for transportation expenses when his/her car is being repaired due to an accident or damage covered by the policy.

KEY TAKEAWAYS

Can I get Loss-of-use coverage with basic CTPL insurance?

No, Loss of Use coverage is typically an add-on to comprehensive insurance policies and is not available with basic CTPL plans.Does Loss of Use cover only rental cars?

No, Loss of Use coverage can also apply to other forms of transport, such as taxis or rideshare services.For how long can I claim Loss of Use coverage?

Most policies in the Philippines allow you to claim Loss of Use coverage for a maximum of 15 days, although this may vary by provider.How much does Loss of Use coverage cost?

Loss of Use coverage is usually added to comprehensive insurance plans for a small increase in premium. The cost varies depending on the insurance provider and the amount of daily reimbursement offered, but it is generally affordable.Save Up to 60% on Car Insurance Renewal

- CASA Coverage Up To 10 Years Old

- Free Roadside Assistance

- Free Acts of God/Acts of Nature

T&C

T&C

In this article, we'll explore everything you need to know about ‘Loss of Use’ car insurance in the Philippines, including its benefits, how it works, and whether it’s right for you. So, without any delay, let’s get started to understand this car insurance coverage.

Also Read: Roadside assistance coverage: Meaning, benefits, services & more

Key benefits of Loss of Use coverage

Some of the major benefits of Loss of Use coverage in car insurance include -

Ensures continued mobility

Loss of Use coverage allows the applicant to maintain his/her daily routine, whether it’s commuting to work or running errands, even while the vehicle is unavailable.

Reduces financial burden

Without this coverage, the cost of renting a car or using public transportation can quickly add up. Loss of Use insurance helps alleviate that financial strain.

Flexibility in transportation choices

The applicant can either rent a car or use other forms of transport, such as taxis, rideshare services, or public transport, and still receive compensation for those expenses.

How Loss of Use coverage works

Once a car is involved in an accident or suffers damage that is covered by its insurance policy and the insurer approves the repair, the applicant can start making claims under Loss of Use coverage. Here the insurer will provide the owner of the damaged car with a per diem amount that can be used for transportation expenses. This daily allowance varies depending on the insurance provider and the terms of your policy. In the Philippines, many insurers offer reimbursement of up to PHP 1,000 per day for up to 15 days.

Key points about how Loss of Use coverage works -

- Eligibility: Loss of Use coverage typically applies only if the car is undergoing repairs due to an insured incident. Some policies might not cover certain situations like total loss (when the car is beyond repair).

- Documentation: To claim this coverage, the applicant needs to provide the insurer with evidence such as a repair estimate, receipts for car rental or transport services, and accident reports.

- Maximum compensation: The number of days for which an applicant can claim compensation and the daily reimbursement limit will vary depending on the policy. Insurers in the Philippines generally provide cover for a maximum of 15 days.

Also Read: Should you insure your old car? Let’s find out

Loss of Use coverage: Major queries answered

Applicants often have questions relating to Loss of Use coverage including - Is it included in all car insurance policies, can an applicant claim it without renting a car, and many more. Let us find out

#1 Is Loss of Use coverage included in all car insurance policies?

Well, no, not all car insurance policies automatically include Loss of Use coverage. It is generally offered as an optional add-on to comprehensive insurance policies. Basic Compulsory Third-Party Liability (CTPL) plans typically don’t provide this coverage, but many comprehensive policies that cover own damage or theft include it.

Remember, before purchasing a car insurance policy, it's crucial to check if Loss of Use coverage is part of the package or if it can be added for an extra fee.

#2 Can an applicant claim Loss of Use coverage without renting a car?

Interestingly, in some cases, applicants may be able to claim reimbursement even if he/she does not rent a car. Well, all this depends on the fine print of the car insurance policy. For instance, instead of renting a vehicle, car owners may opt for public transport, and insurers will issue reimbursement based on the daily allowance.

Alternatively, some insurers allow compensation for the estimated inconvenience caused during the period the car is out of service, even if the owner doesn’t rent another vehicle.

#3 Under what circumstances might Loss of Use coverage not be useful for an applicant?

While Loss of Use coverage is beneficial in most situations where your car is under repair, it doesn’t apply in all circumstances including -

Total loss: If the insured car is declared a total loss, meaning it cannot be repaired or the cost of repair exceeds the car’s value, Loss of Use coverage will not apply. Instead, the insurance provider will compensate you for the value of the vehicle.

Excluded damages: If the insured car is damaged in a way not covered by your policy, such as an excluded peril (e.g., intentional damage or unreported modifications), the applicant will not be able to claim under Loss of Use.

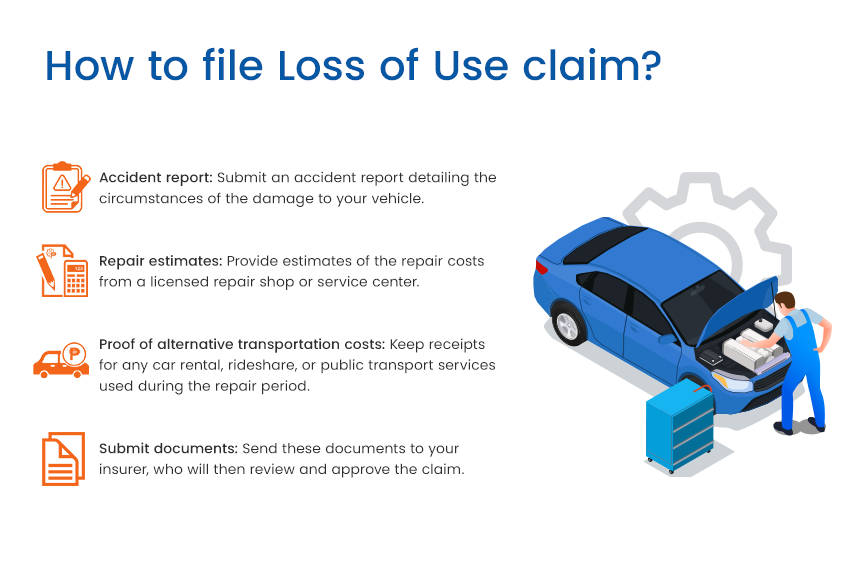

The process to file a Loss of Use claim

The process of filing a Loss of Use claim in the Philippines generally mirrors other types of car insurance claims and includes the following essentials-

- Accident report: Submit an accident report detailing the circumstances of the damage to your vehicle.

- Repair estimates: Provide estimates of the repair costs from a licensed repair shop or service center.

- Proof of alternative transportation costs: Keep receipts for any car rental, rideshare, or public transport services used during the repair period.

- Submit documents: Send these documents to your insurer, who will then review and approve the claim.

Loss of Use coverage: Needed or not

When selecting a car insurance policy in the Philippines, it’s important to consider whether Loss of Use coverage aligns with your needs. This coverage is especially useful for people who depend heavily on their vehicles for daily commutes or business. For others, who may have alternative transportation readily available, it may not be as critical.

It's also worth noting that Loss of Use coverage may slightly increase your premium, but for many drivers, the peace of mind it offers is well worth the investment.

Bottom line

Loss of Use coverage is a valuable add-on to any comprehensive car insurance policy in the Philippines, providing financial protection for alternative transportation when your vehicle is unavailable due to repairs. While it may come with an additional cost, its benefits far outweigh the expense, especially for those who rely on their cars for daily activities.

We’d say it again, before purchasing a policy, carefully review your options to ensure you have the right coverage for your needs.

Also Read: Is collision insurance right for you? Here’s what you need to know

Featured Articles

- Latest

- Popular

Recommended Articles For You

Featured Cars

- Latest

- Upcoming

- Popular

Car Articles From Zigwheels

- News

- Article Feature

- Advisory Stories

- Road Test