Compulsory Third Party Liability (CTPL) 101: Everything a car buyer needs know

- KEY TAKEAWAYS

- What is CTPL?

- What purpose does CTPL serve?

- What information is found in a CTPL insurance policy?

- CTPL insurance policy premium

- How is CTPL different from comprehensive car insurance?

- CTPL: Coverage, non-coverage, & exclusions

- How much coverage does CTPL insurance offer?

- Fees and validity

- Step-by-step guide to getting a CTPL insurance policy

We recently shared insights related to the real cost of owning a car in the Philippines, one of the key points being Compulsory Third-Party Liability (CTPL) Insurance. As promised, here we are with an in-depth article on the subject, which, as the name suggests, is a mandatory requirement.

KEY TAKEAWAYS

Is third-party insurance mandatory in the Philippines?

Yes. Third-party car insurance is a must in the Philippines no matter the type of vehicle, be it a private, commercial, motorcycle, or truck.Is CTPL needed before motor vehicle registration?

Yes. A motor vehicle owner needs to get a CTPL insurance policy before registering the car or motorbike with the LTO.Who is not covered by CTPL?

Following individuals are not covered under CTPL - Family and close relatives, employee passengers working for you, passengers of public transportation, and passengers of service vehicles.How much does a CTPL insurance policy cost in the Philippines?

CTPL is relatively cheaper compared to comprehensive car insurance. It can range from PHP 500 to PHP 1000, depending on the vehicle.Save Up to 60% on Car Insurance Renewal

- CASA Coverage Up To 10 Years Old

- Free Roadside Assistance

- Free Acts of God/Acts of Nature

T&C

T&C

Yes, every can owner in the Philippines is required to have Compulsory Third Party Liability (CTPL) insurance policy. It is something a car owner needs to acquire even before vehicle registration.

What are we discussing about CTP? Well, a lot of things including its meaning, policy inclusions, premium, coverage, amount & duration, validity, fees, how & where to acquire, names of licensed CTPL insurance companies, and much more.

So, without any delay, let’s get started and know all about Compulsory Third Party Liability insurance policy.

What is CTPL?

Starting from the very basics, CTPL stands for Compulsory Third Party Liability insurance. It is a mandatory requirement by the Department of Transportation and is meant to protect the general public in the event of an accident.

Here are its key highlights -

- It is one of the requirements for a motor vehicle to get registered in the Philippines.

- It is also a prerequisite for registration renewal.

- Both commercial and private vehicles need to have CTPL insurance.

- Most of the time, CTPL insurance for a motor vehicle includes a policy and a Confirmation of Cover (COC).

- COC serves as a proof of third-party insurance cover and is then presented to the LTO, which then proceeds with the MV registration.

- It aims to protect the general public in the event of an accident by covering third parties injuries and death arising from an insured vehicle.

- It only pays for the expense incurred by the third party due to the accident and does not compensate the driver or passengers sitting in the insured vehicle.

Third party means anyone apart from the family members, employees of the insured and passengers sitting in the motor vehicle at the time of accident.

Overall, CTPL is a shield for a vehicle owner against third-party liability (death or injury) arising due to a road accident involving the insured vehicle.

What purpose does CTPL serve?

As discussed above, CTPL is a mandatory requirement by LTO serving as a prerequisite for motor vehicle registration and registration renewal. However, it serves more important purposes, such as acting as a proof of third party insurance cover, providing financial protection to the general public in case of an accident involving an insured vehicle, and serving as an assurance of insurance policy in place.

What information is found in a CTPL insurance policy?

When it comes to inclusion in the CTPL insurance policy, we first need to know what all the documents the insured gets from the company. For the insured vehicle, the owner gets an insurance policy with conditions and a Confirmation of Cover. As discussed earlier, COC is presented to the authorities at the LTO at the time of vehicle registration serving as a proof that the vehicle has third-party insurance cover.

Following is the information found in the Confirmation of Cover (COC) -

- Name of the car owner/assured

- Basic vehicle details like chassis number, plate number, serial number, colour, etc

- Liability limit

- Medical and hospital reimbursement

- Third-party benefits (death benefit, funeral expenses, dismemberment, permanent disablement)

CTPL insurance policy premium

A car owner can acquire a CTPL insurance policy from any licensed insurance company (list given below). However, the premium is mandated by the Insurance Commission, and there can’t be any alterations, whether they are more or less. In case of any discrepancy, a report must be filed with the Insurance Commission.

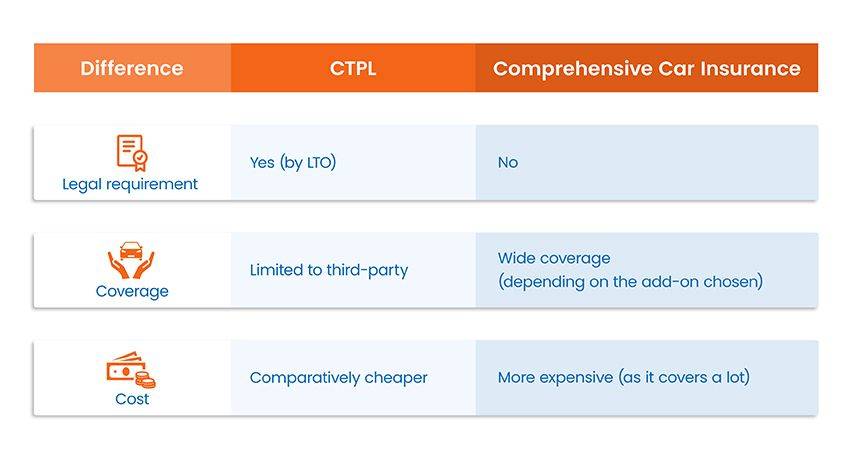

How is CTPL different from comprehensive car insurance?

Many times, we find owners getting confused between Compulsory Third-Party Liability insurance and comprehensive car insurance. So, we took it upon ourselves to write a detailed article comparing the two. You can check it out here.

However, to give you a brief overview, CTPL insurance is a mandatory requirement by the LTO and offers coverage only to the third party in case of an accident or injury caused by the insured car. Compared to comprehensive car insurance, it is quite basic and cheap and that's why it does not cover damages to the insured car and injuries of the owner.

Comprehensive car insurance, on the other hand, is not a legal requirement like CTPL. However, its wider coverage makes it a must-have for any vehicle owner. One of its key benefits is the flexibility to pick the add-ons, allowing you to select coverage for your own damage, theft, acts of God, passenger personal accident, towing, and roadside assistance.

Also Read: Compulsory Third-Party Liability Insurance (CTPL) vs. Comprehensive Insurance: What's best for you?

CTPL: Coverage, non-coverage, & exclusions

By now, you must be aware that CTPL insurance applies only to third parties. However, in case of an accident, the following can claim coverage - coworkers, passengers, and friends & acquaintances. Coming to what is not covered, well, in addition to the regular exclusions, the following are also not covered by CTPL -

- Individuals travelling via public transport

- Individuals commuting via service vehicles like cable provider, delivery service, etc

- Insured car owners family and close relatives

- Employee passengers working for insured car owner

Now, there are a few situations where even after an accident leading to injury or death of the third party is not covered under CTPL insurance. The list includes accidents/injury occurred during -

- Strikes, civil commotion, and riots

- Flooding, earthquakes, typhoons, or any other natural calamity

- Threat of conflict

- When the vehicle is driven by an unauthorised person

- When the vehicle is driven in a manner which is not in compliance with the vehicle’s restrictions

- Incident happened outside the Philippines

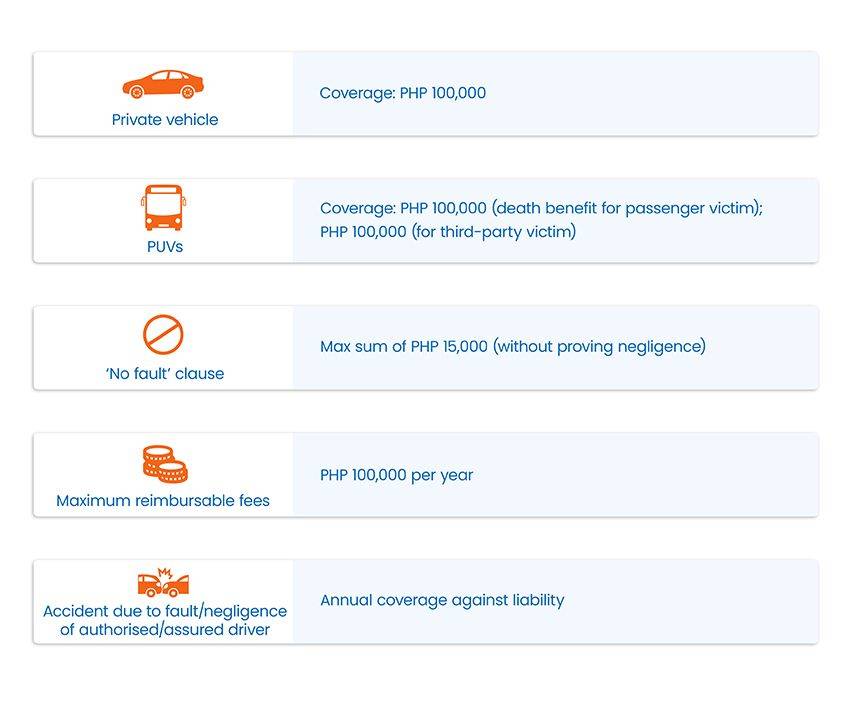

How much coverage does CTPL insurance offer?

The coverage CTPL insurance policy offers differs with the vehicle type, clause and other. The table below gives you in-depth detail on the subject.

Fees and validity

Similar to motor vehicle registration, CTPL coverage is valid for a year and, therefore, needs to be renewed annually. For the same reason, COC is a prerequisite for motor vehicle registration renewal.

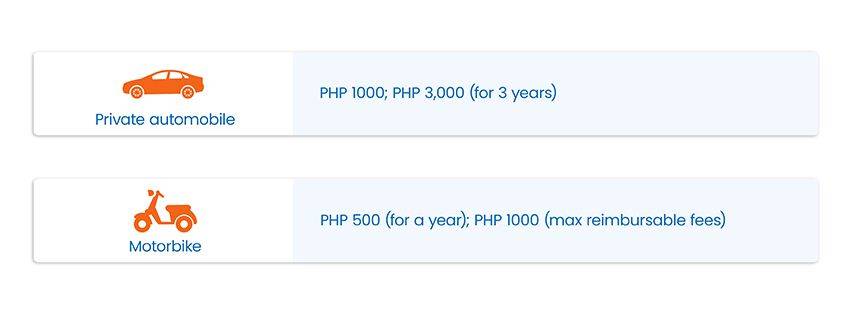

Coming to the fees, while the CTPL price is a bargain, one needs to pay the following amounts for the coverage it offers.

Step-by-step guide to getting a CTPL insurance policy

Now, it is time to discuss how and from where to acquire CTPL insurance policy in the Philippines. So, let’s get started

Step 1: Get the prerequisites ready

- Vehicle’s Original Receipt and Certificate of Registration (OR/CR)

- Driver’s licence

- One valid government-issued ID

- Photocopy of the above documents

Step 2: Pick an insurance provider

- Choose an LTO-accredited CTPL insurance provider

- Buy your insurance policy from the chosen provider

Step 3: Receive documents

- Upon purchasing the insurance policy, the car owner will receive the policy (with conditions) along with a Certificate of Cover (COC)

Step 4: Time to go to LTO

- Make duplicate copies of the insurance policy and COC

- Take them along to LTO for car registration and registration renewal

Note: The LTO licenses more than 70 insurance companies; you can check the complete list here.

Also Read: A step-by-step guide on how to claim car insurance in the Philippines

Bottom Line

The LTO legally requires a Compulsory Third-Party Liability (CTPL) insurance policy; however, it still serves the purpose of protecting third parties in the event of an accident. However, one must make sure that CTPL is acquired from a legitimate source and not from a make-believe company claiming to have its setup in the LTO.

Also Read: Why comprehensive insurance is vital for car owners in the Philippines

Featured Articles

- Latest

- Popular

Recommended Articles For You

Featured Cars

- Latest

- Upcoming

- Popular

Car Articles From Zigwheels

- News

- Article Feature

- Advisory Stories

- Road Test