Compulsory Third-Party Liability Insurance (CTPL) vs. Comprehensive Insurance: What's best for you?

After buying a new car, the first step of responsibility you should take as the car owner is getting a car insurance policy. It plays a vital role in providing you with financial security and protection against unforeseen events. There are mainly two types of car insurance in the Philippines - CTPL insurance (Compulsory Third-Party Liability Insurance) and Comprehensive insurance.

Save Up to 60% on Car Insurance Renewal

- CASA Coverage Up To 10 Years Old

- Free Roadside Assistance

- Free Acts of God/Acts of Nature

T&C

T&C

In this guide, we'll delve into the differences between compulsory third-party liability insurance and comprehensive insurance. We'll break down what each type of policy covers, highlight their pros and cons, and discuss frequently asked questions associated with them. So, let’s get started.

Before diving into the comparison, let’s understand their meaning first.

What is CTPL (Compulsory Third-Party Liability Insurance)?

As the name implies, the CTPL (Compulsory Third-Party Liability Insurance) is compulsory for vehicle registration in the Philippines, as mandated by the Land Transportation Office (LTO).

Also referred to as TPL (Third-Party Liability) in the Philippines, it protects you against legal liabilities for bodily injury caused to a third party (including passengers, pedestrians, and other motorists) in an accident where you are at fault. The CTPL ensures that the affected third party receives proper medical care and financial support.

Notably, it is a basic or standard insurance that does not cover damages to you (the policyholder) and your car (the insured vehicle), leaving you vulnerable to significant financial losses in case of any incidents.

Are you wondering why TPL is mandatory in the Philippines? Well, It is necessary because of the high number of road accidents, leading to 32 deaths every day (according to a report published by SunStar). The financial and legal consequences for those involved in the accidents would be challenging without insurance. Thus, LTO has made it compulsory to ensure that victims receive fair compensation for their losses and to promote road safety.

What is Comprehensive Insurance?

Comprehensive Insurance is a full-coverage car insurance policy that offers extensive coverage for a wide range of risks associated with owning and driving a car. It covers damages resulting from accidents, theft, vandalism, natural disasters, and other unforeseen events. It offers a comprehensive shield against financial losses that may arise from various circumstances.

In short, Comprehensive car insurance protects you, your car, your occupants, as well as third parties from various risks and uncertainties encountered while driving.

Difference between CTPL and Comprehensive Insurance

The documents required for getting an auto car insurance policy (CTPL or comprehensive) in the Philippines are as follows -

- Driving license

- Original Receipt (OR) and Certificate of Registration (CR) of the vehicle

- Previous vehicle insurance policy, if any

- Deed of sale in case of the pre-owned vehicle

- Any valid government ID, other than the driving license

- Photos of the vehicle

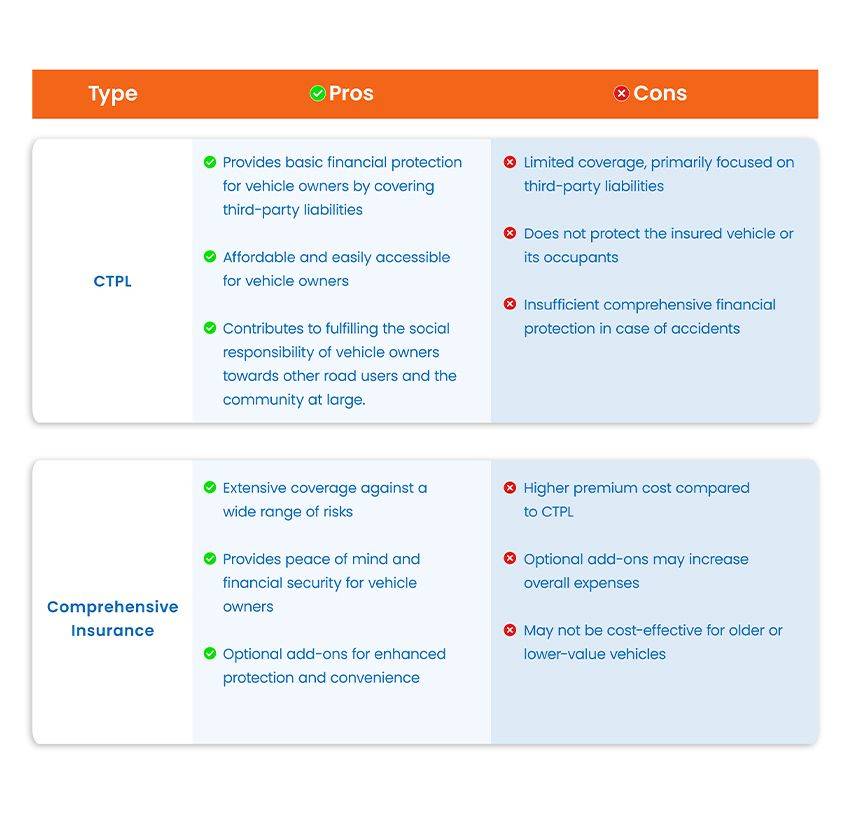

CTPL and Comprehensive Insurance: Pros & cons

FAQs related to CTPL vs Comprehensive Insurance

Which one should I choose - CTPL or Comprehensive Insurance?

CTPL is compulsory in the realm of Car Insurance Philippines and provides basic coverage for third-party liabilities. Therefore, it's crucial not to overlook this aspect. On the other hand, Comprehensive Insurance is not a legal obligation but it offers a sense of security knowing that you and your investment are secured against any potential risks encountered on the road.

Choosing Comprehensive Car Insurance can be a wise decision as it provides both third-party coverage and damage cover. Moreover, you have the option to customize your policy with add-ons to expand its coverage.

What factors should I consider when choosing between CTPL and Comprehensive Insurance?

The factors you need to consider when choosing between CTPL and Comprehensive - include your budget, the value of your vehicle, your risk tolerance, and the level of coverage you require.

Can I have both CTPL and Comprehensive Insurance for my car?

Yes, of course. You can opt to have both CTPL and Comprehensive Insurance for added protection.

Can I cancel my Comprehensive car Insurance policy at any time?

Yes, you can cancel your Comprehensive car Insurance policy at any time by informing your insurer. However, you may be subject to cancellation fees or penalties, and you may lose any unused premiums or discounts.

How do the claim procedures differ between CTPL and Comprehensive Insurance?

The claim process is generally consistent across both types of insurance, with differences primarily driven by specific regulatory requirements.

What are some of the best CTPL Insurance providers in the Philippines?

Some of the top CTPL Insurance providers in the Philippines include Alpha Insurance and Surety Corp, Oona Insurance, and FPG.

What are some of the best comprehensive Insurance providers in the Philippines?

Alpha and Oona Insurance are among the best in terms of efficiency in issuance and convenience in claims services.

How can I calculate the premium for CTPL or Comprehensive Insurance?

For CTPL or comprehensive insurance premiums in the Philippines, you may use your preferred insurance company’s premium calculator or request car insurance quotes from Carmudi.

Summing up

Now that you understand the differences between CTPL and Comprehensive car insurance, you can make an informed decision. Assess your circumstances, budget constraints, and risk appetite to choose the one that offers you the peace of mind you need while on the road.

Also read: Choosing the right car insurance policy in the Philippines

Featured Articles

- Latest

- Popular

Recommended Articles For You

Featured Cars

- Latest

- Upcoming

- Popular

Car Articles From Zigwheels

- News

- Article Feature

- Advisory Stories

- Road Test