Car Insurance for pre-owned vehicles: A comprehensive guide

Buying a pre-owned vehicle can often be a wise financial decision for many individuals who might want to save money, access a wider selection of models, or avoid the rapid depreciation associated with new cars. Regardless of the motivation, one aspect that remains constant with brand-new and used cars is the need for adequate insurance coverage.

Save Up to 60% on Car Insurance Renewal

- CASA Coverage Up To 10 Years Old

- Free Roadside Assistance

- Free Acts of God/Acts of Nature

T&C

T&C

Car insurance for pre-owned vehicles, also known as used car insurance, is essential for protecting your investment and ensuring peace of mind on the road. In this comprehensive guide, we will walk you through the process of buying insurance for pre-owned vehicles and offer valuable insights to help you make informed decisions.

Options for insuring pre-owned vehicles

There are two ways of getting used car insurance in the Philippines - retain the vehicle’s existing insurance policy or explore new options.

A. Retain the vehicle’s existing insurance

As the new owner of a second-hand car, you have the option to retain the existing insurance policy. However, this option is applicable only when the previous owner has not cancelled the car’s policy. To retain the existing insurance policy, you need to get it transferred to your name right after finalising the vehicle sale.

This option can be beneficial in many ways such as continuity of coverage and potentially lower premiums. Before deciding to stick with the current insurance policy, you must review the coverage it offers and ensure that it meets your requirements.

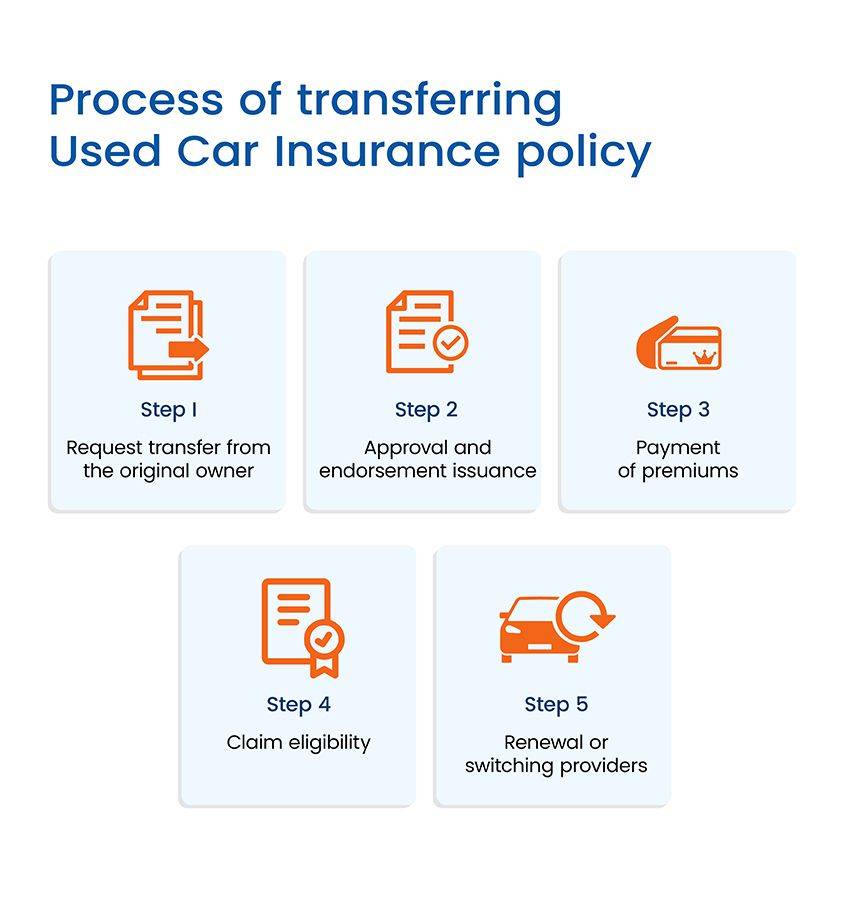

Process of transferring used car insurance policy -

Request transfer from the original owner: The seller or original owner of the vehicle is responsible for initiating the transfer process. They will contact their insurance provider to request the transfer of the policy to your name.

Approval and endorsement issuance: Once the insurance provider approves the transfer request, they will issue an endorsement reflecting your name as the new policyholder. This endorsement serves as confirmation that the policy has been successfully transferred to you.

Payment of premiums: Following the transfer of the insurance policy to your name, you will be responsible for paying the premiums for the upcoming years as the new policyholder. Ensure timely payment to maintain continuous coverage for your second-hand vehicle.

In the event of any policy modifications, such as changing the car usage from private to commercial, an additional premium may be charged, which the new owner will need to pay to maintain continuous coverage.

Claim eligibility: With the car insurance policy transferred to your name, you are eligible to make claims in case of accidents or damages requiring repairs.

Renewal or switching providers: Before the transferred car insurance policy expires, you have the option to either renew it with the current provider or switch to a new insurance provider. You can evaluate all the options carefully to get the best value for your money.

B. Get a new Insurance policy for pre-owned vehicles

Alternatively, you can choose to get a new insurance policy for your newly bought used car particularly tailored to your needs and budget. This can be a wise choice for different reasons such as the desire for better coverage options or competitive pricing.

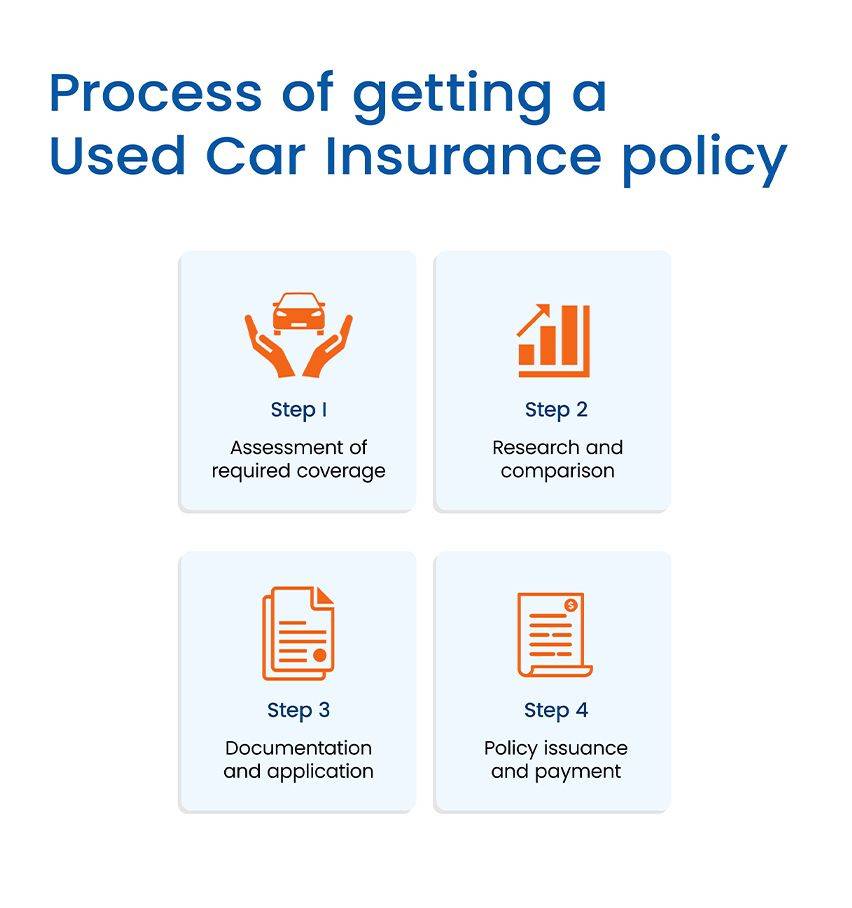

Process of getting a used car insurance policy

Assessment of required coverage

The first step in buying a used car insurance policy is to assess your insurance needs diligently. You need to determine the types of coverage you need, whether it's basic CTPL or comprehensive protection against accidents, theft, vandalism, or acts of nature. You also need to decide whether you want add-ons like towing assistance in case of any accidents.

Research and comparison

After carefully identifying your insurance needs, the next step is to research and compare different car insurance policies available in the Philippines. There are several insurance providers which offer the cheapest car insurance for pre-owned vehicles but they assess the making year, model, age, and condition of the vehicle before providing protection. Notably, used vehicles that are less than 10 years old and in good working condition, with a clean vehicle history, are eligible for insurance policies with lower premium rates. If your used car does not fit this criteria, you might find a problem in getting it insured.

Gather second-hand car insurance prices/quotes from multiple insurers and compare the policies on the basis of premium rates, deductibles, and coverage limits. Carmudi offers you car insurance quotes from top car insurance companies in the Philippines simply by providing your vehicle details.

Compare the quotes as well as insurance companies to choose the one with a solid financial track record, 24x7 customer service, and efficient claims process. Some of the most reputed insurers are - FPG Insurance, OONA, Mercantile Insurance, Bethel Gen, and FGen Insurance.

Documentation and application

After selecting the insurance company and the policy you need, go ahead and fill the application form alongside submitting all the required documents.

The list of documents required for old car insurance renewal includes -

- Driving licence of the new owner

- Photocopy of the Original Receipt (OR)

- Notarized Deed of sale

- Certificate of Registration (CR) bearing new owner’s name

- Any valid Government ID, other than the driving licence

Upon receiving all the documents, the insurance company may appoint an executive to physically inspect the condition of your used car before approving the policy.

Policy issuance and payment

If your policy gets approved, you will receive confirmation along with details of the premium amount. You can pay the premium in full or in installments, depending on the insurer. Once payment is processed, you will receive the new insurance policy via email or by mail at your mailing address.

FAQs related to used car insurance

Is it mandatory to get insurance for pre-owned vehicles in the Philippines?

Yes, it is mandatory to have insurance for any vehicle, whether new or used, in the Philippines. The minimum requirement is third-party liability insurance.

Are older cars cheaper to insure?

Yes, insurance for older cars is often cheaper due to their lower market value. However, certain older cars with expensive replacement parts may get insured at higher insurance premiums.

What types of insurance coverage are available for pre-owned vehicles in the Philippines?

There are several types of insurance coverage available for pre-owned vehicles in the Philippines, including CTPL, comprehensive, and other additional coverage options.

Which insurance policy is better for an old car?

A comprehensive car insurance plan is usually better for an old car as there is a higher chance of their breakdown and the repairing cost can also be high because of less availability of older parts.

How do I determine the value of my used car for insurance purposes?

The value of your used car is typically based on its market value or the amount specified in the Deed of Sale. However, insurance companies also consider the vehicle’s age, make, model, and condition.

Can I get insurance for a vehicle that is more than 10 years old?

Yes, insurance coverage is available for vehicles that are over 10 years old. However, the availability of coverage and premium rates may vary depending on the condition and history of the vehicle.

Can I get insurance for a modified used car in the Philippines?

Standard car Insurance policies do not cover certain types of car modifications in the Philippines.

Tips for insuring used cars

When insuring a pre-owned car in the Philippines, consider the following tips to make the right decision:

- Before purchasing insurance for the used car, conduct a thorough inspection to assess its condition and identify any existing issues that may affect coverage.

- Make sure the insured value reflects the true market value of the pre-owned vehicle to avoid overpaying for coverage.

- Check out available discounts to lower your insurance premiums.

- Read all the terms and conditions carefully and understand the extent of coverage provided by the insurance policy.

- Understand the claim filing procedure and the insurer's response time to avoid complications in case of any incidents.

- Periodically review your used car insurance policy and modify it as per the vehicle’s condition or personal circumstances.

To sum it up, getting insurance for your newly bought used car is a smart move to safeguard the vehicle and yourself from unforeseen events on the road. Figure out what coverage you need, explore different options, and snag a deal that fits your budget.

Also read: Compulsory Third-Party Liability Insurance (CTPL) vs. Comprehensive Insurance: What's best for you?

Featured Articles

- Latest

- Popular

Recommended Articles For You

Featured Cars

- Latest

- Upcoming

- Popular

Car Articles From Zigwheels

- News

- Article Feature

- Advisory Stories

- Road Test