Seriously, Can You Really Afford a Car Loan Right Now?

So you want to buy a car? Before you do that, ask yourself first if what you're earning right now is more than enough for you to get a car loan. For all you know, you might have the budget to pay for the downpayment, but not enough to pay for the monthly payments in the long run.

@http://myfinancialcoach.ph

@http://myfinancialcoach.phThere are actually three laws of car financing that you should keep in mind. They can come in pretty handy if you want to assess whether or not you can afford to get a car loan right now.

1. Pay 20 percent of the downpayment

You probably already know that your car depreciates the moment you take it out of the car dealership -- around nine percent of its value, according to many car experts. If that's the case, then you can probably imagine how much value it will lose over a year, two years, or even five.

Making your downpayment lower than 20 percent may make it difficult for you to pay your monthly loans, since the interest itself, together with the monthly payments you'll pay, might eventually add up to more than your car's total value.

2. Try to shorten your car loan to no more than four years

Four years (three years is the ideal) is a good number of years to enjoy your car, which, by this time, has already lost a huge chunk of its value already -- but not all of it.

Besides, interest rates are notorious for getting out of hand the longer you're paying for a loan. This is because the rates go higher the longer the term.

Also, the chances of skipping a payment is bigger the longer you're paying your car loan. And not paying for a month or two can add up to a huge balance that may be difficult to pay, especially if your salary is just "enough" for all your expenses. This can cause a snowball effect in the next coming months -- and may cause you to end up in increasing debt.

3. Make sure your monthly amortization doesn't exceed 30% of your income

Others say it should be 10 percent (which we think is better), but many Philippine banks seem to go with the 30 percent limit.

Whatever the case, remember that you have other things to pay for. Don't go overboard on your car payments, or it will eat up all your savings and budget for other, more important things.

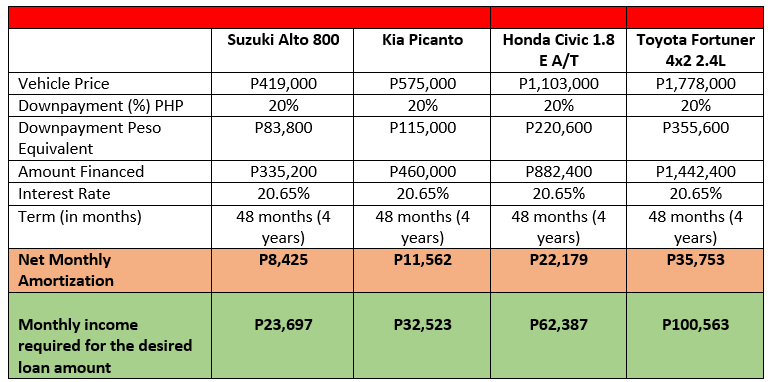

Comparison of Cars and their Actual Car Loan Rates

Now that you know the laws, let's look at the actual breakdown of some current, brand new car loans* and their suggested income.

So as you can see, those with salaries on the P25,000 bracket can generally get a car loan for a Suzuki Alto 800. Opting for a Kia Picanto means you have to have around P33,000 to get a car loan and stay safely afloat every month.**

Keep in mind, however, that this is only applicable for those with good credit ratings. No matter how high your salary is, there's no way you can get a car loan if your credit history has red flags all over it.

So, now that you've looked at the chart, can you seriously say you can afford to get a car loan right now? Remember that getting one is a serious commitment on your part. You can't just quit halfway because you got laid off, your house gets repossessed by the bank, or your business venture was a flop. Make sure you do your research first before you decide it's time to take the plunge.

---

*Data provided by PSBank Antipolo.

**Note that these figures don't include car insurance.

Featured Articles

- Latest

- Popular

Recommended Articles For You

Featured Cars

- Latest

- Upcoming

- Popular

Car Articles From Zigwheels

- News

- Article Feature

- Advisory Stories

- Road Test